How to Start Poloniex Trading in 2024: A Step-By-Step Guide for Beginners

How to Trade Crypto in Poloniex on PC

1. Visit Poloniex.com, choose [Log in]

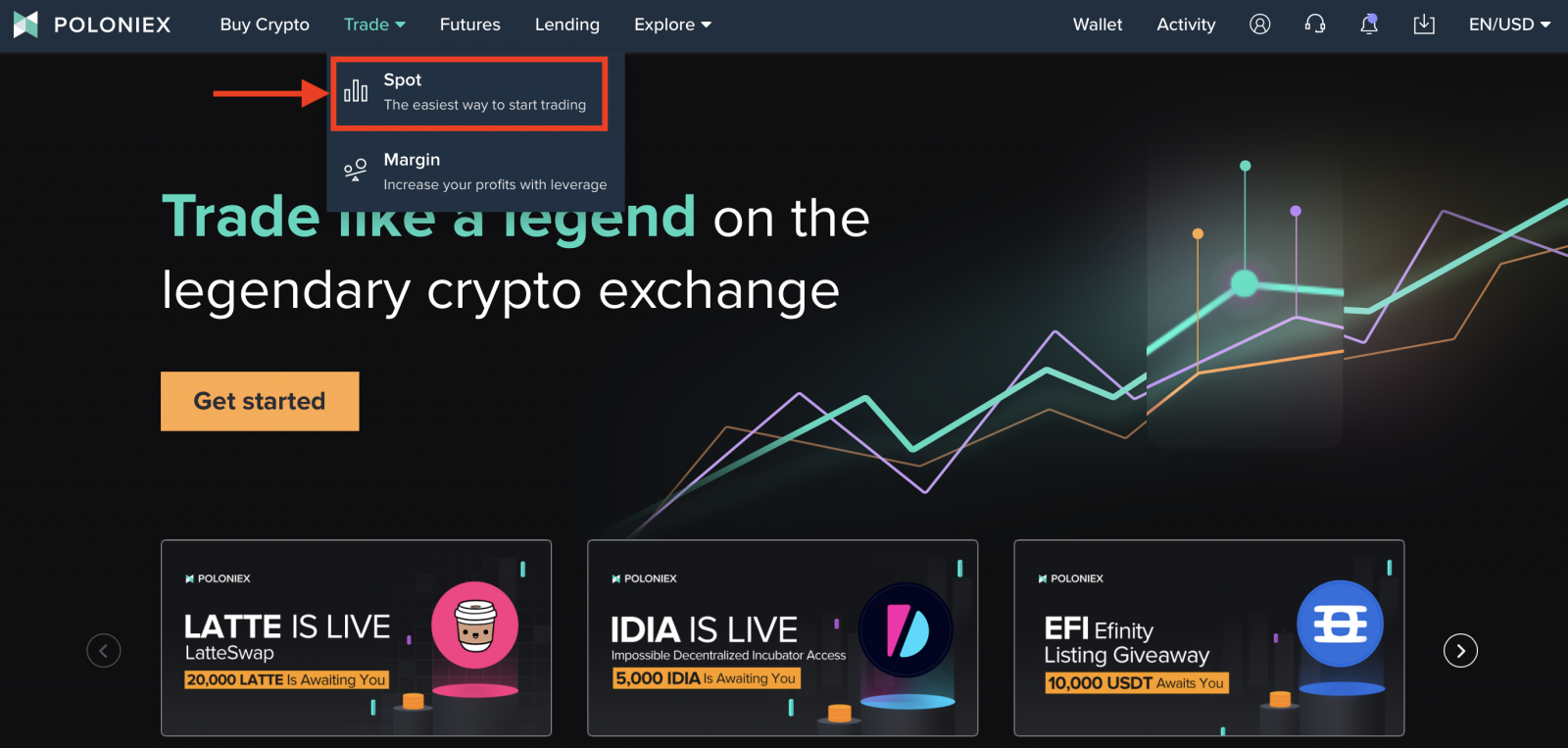

2. Click [Trade]

3. Click [Spot]

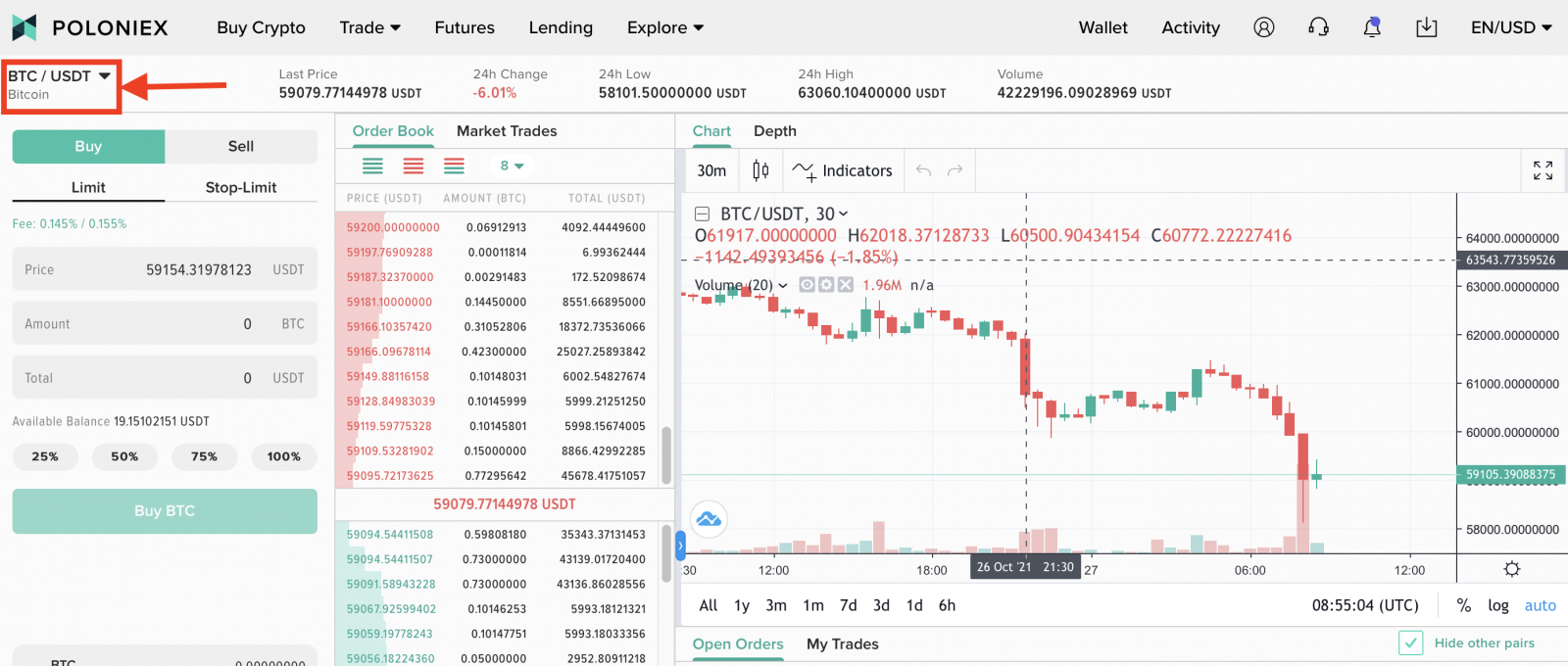

4. Select a trading pair to buy or sell. Take BTC/USDT as an example:

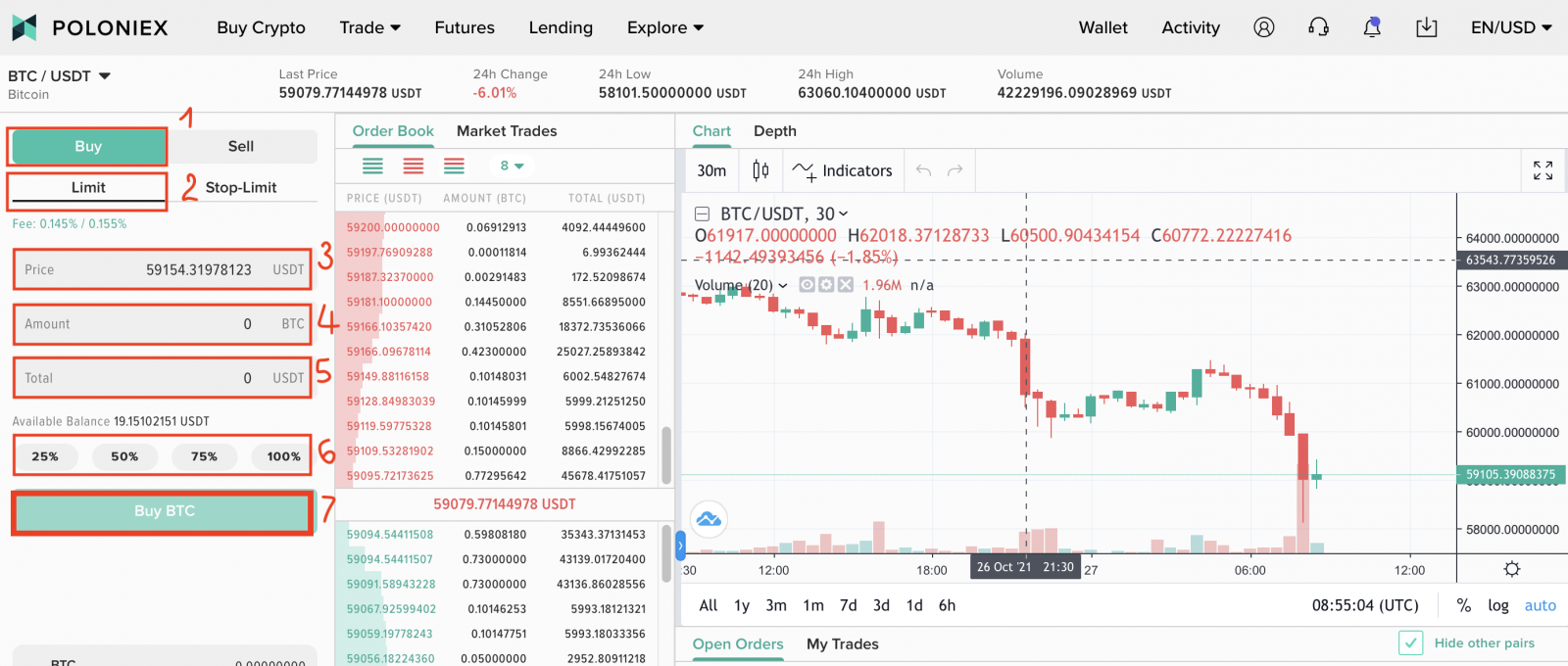

5. Select [Buy] BTC/USDT as an example:

-

Click [Buy]

-

Click [Limit]

-

Enter The Price you want to buy that token

-

Enter Amount of the token you want to buy

-

Check Total amount

-

You can choose the percent of Total amount you have.

-

Click [Buy BTC]

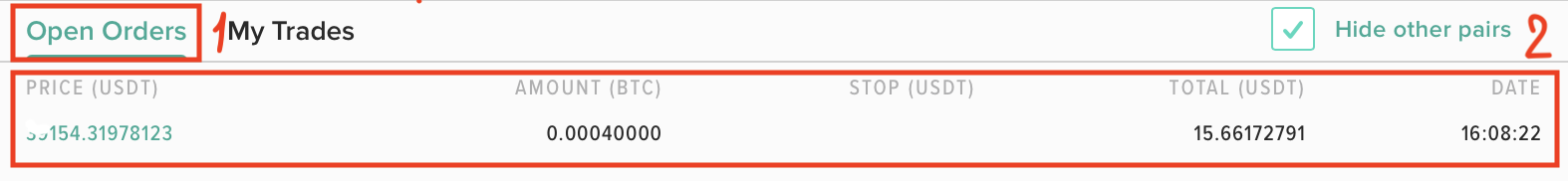

6. You can review your order at [Open Orders]

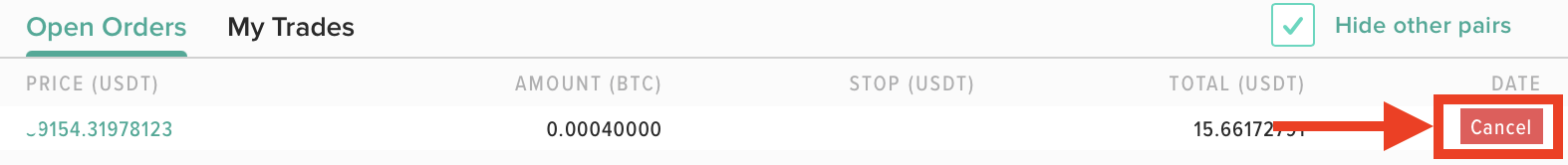

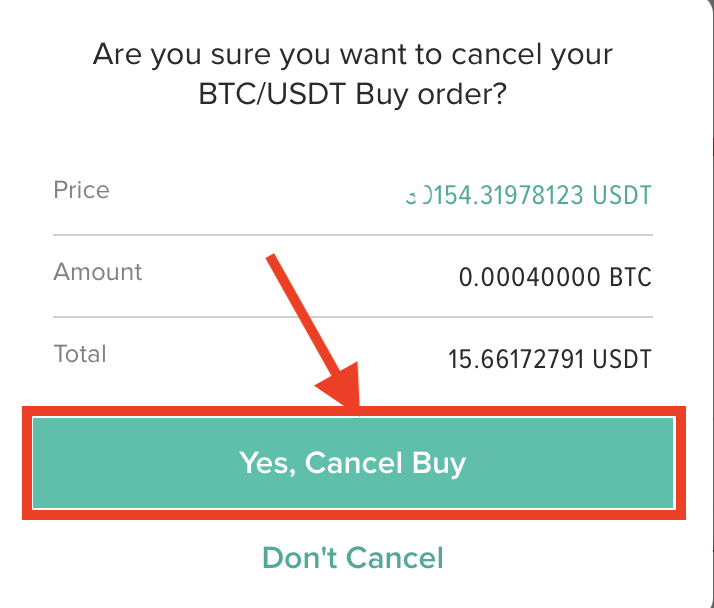

7. If you want to cancel your order:

-

Click [Cancel]

-

Click [Yes, Cancel Buy]

How to Trade Crypto in Poloniex on APP

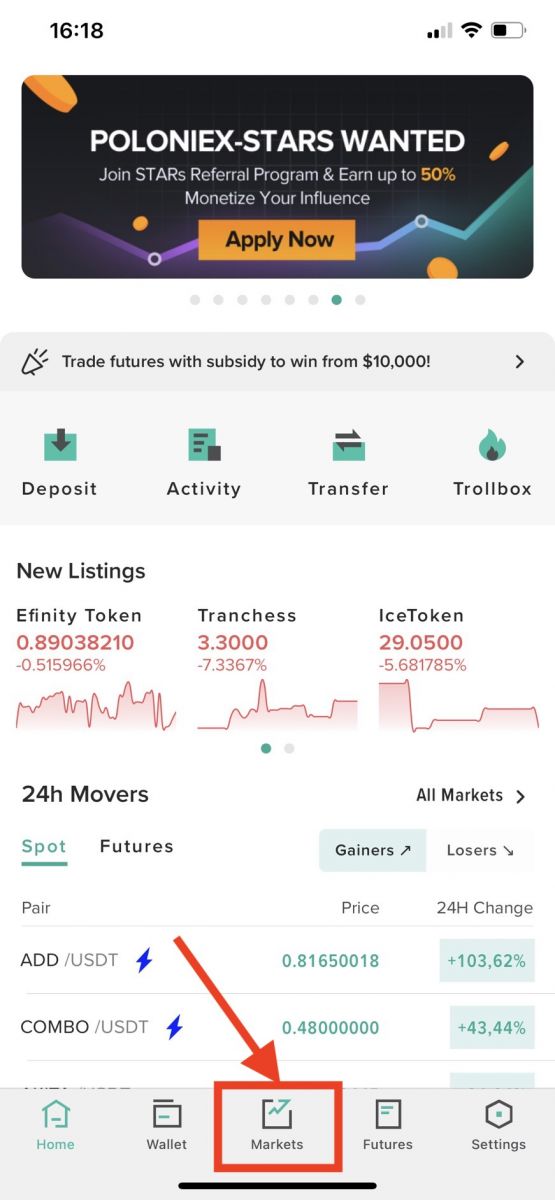

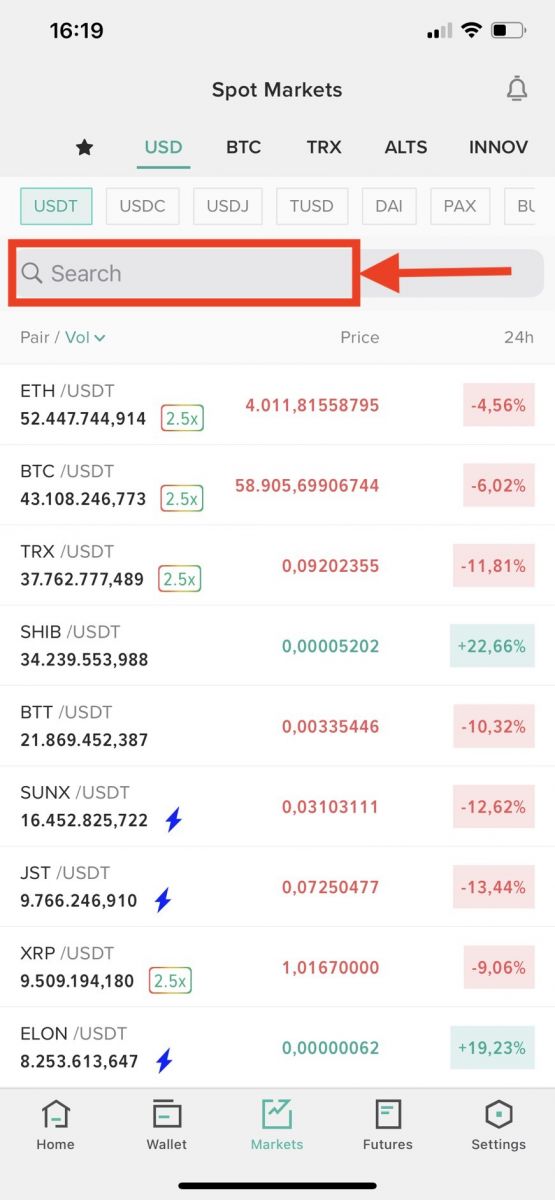

1. Open Poloniex App on your phone and Sign in to your Poloniex Account. Then Click [Markets]

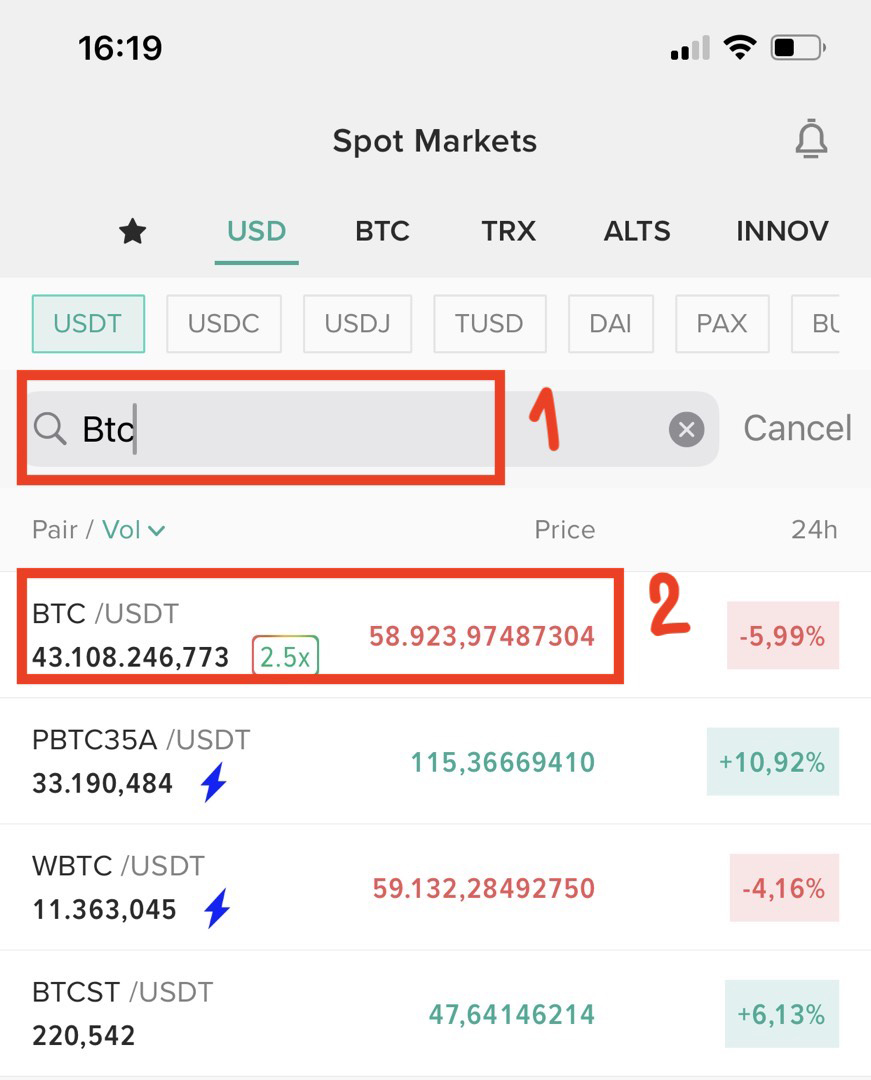

2. Search a trading pair to buy or sell on the search bar.

Take BTC/USDT as an example:

3. Click [Trade]

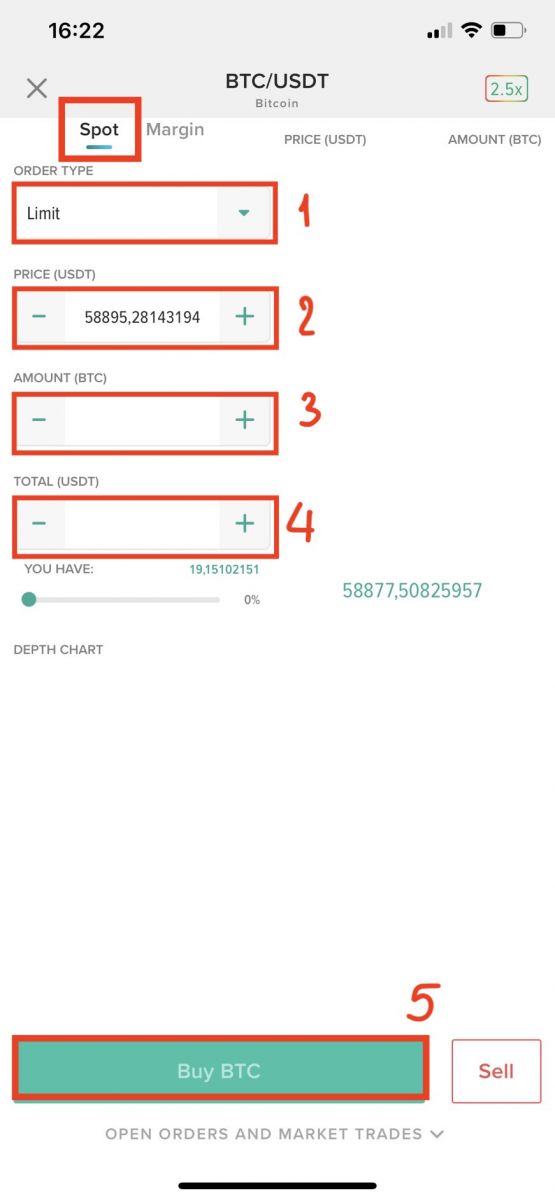

4. . Take Buying BTC/USDT as an example:

Under Spot section:

-

Click [Limit]

-

Enter The Price you want to buy that token

-

Enter Amount of the token you want to buy. You can choose the percent of Total amount you have.

-

Check Total amount

-

Click [Buy BTC]

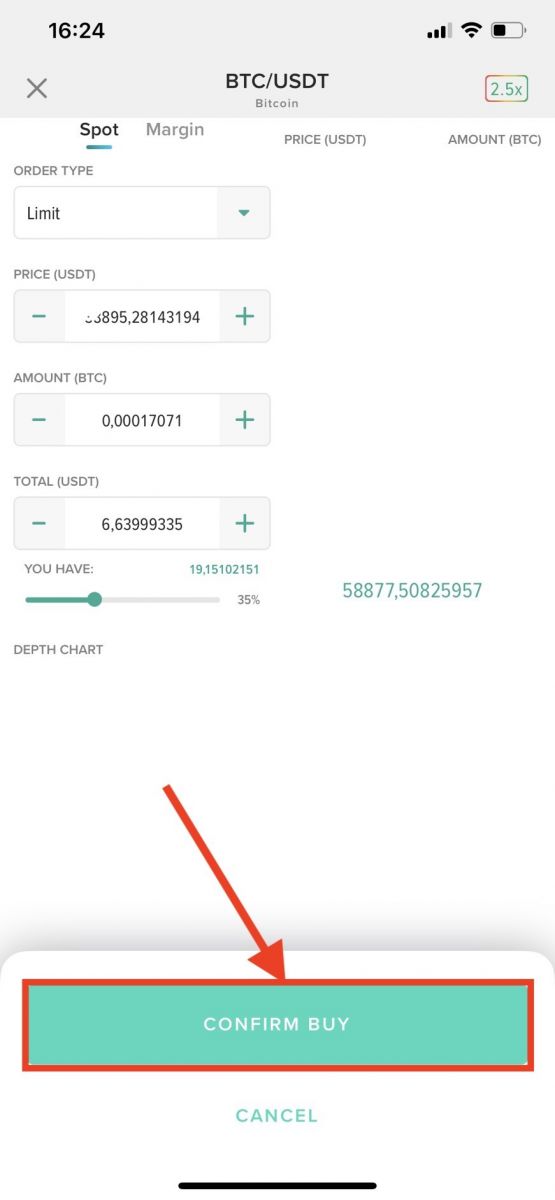

5. Click [Confirm Buy] to confirm your Buying

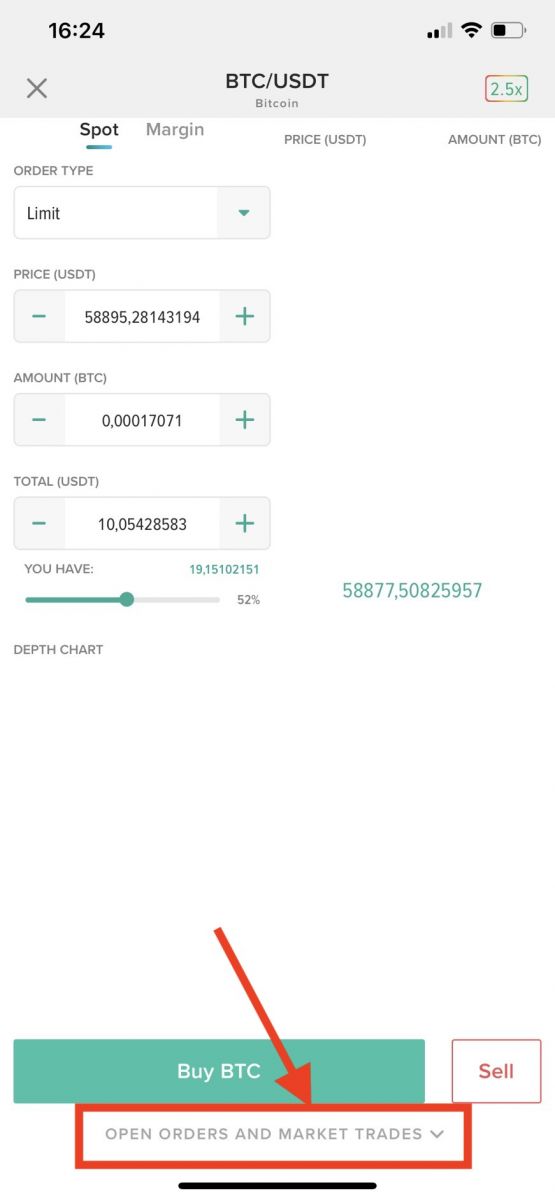

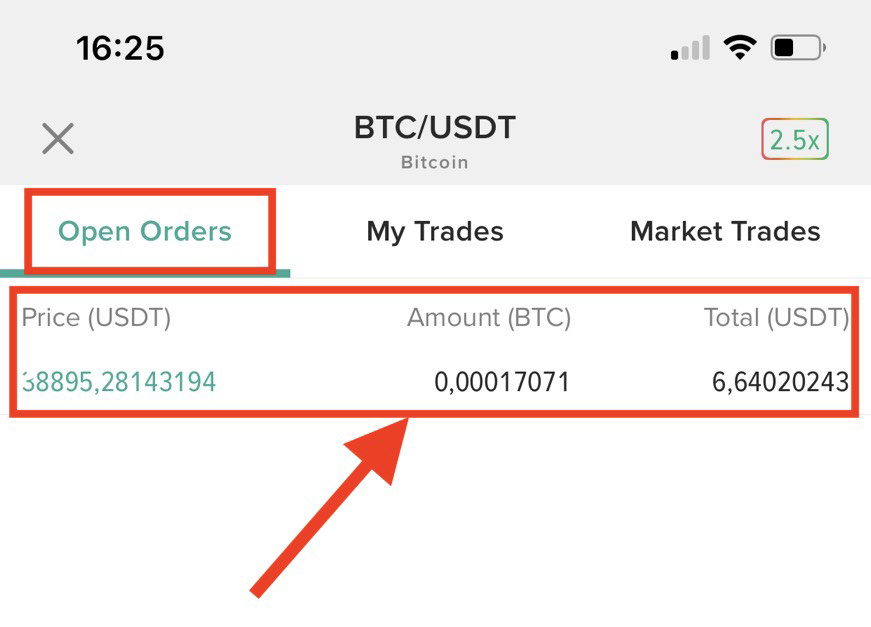

6. You can review your order. Click [Open Orders and Market Trades]

You can see your Orders under [Open Orders] section:

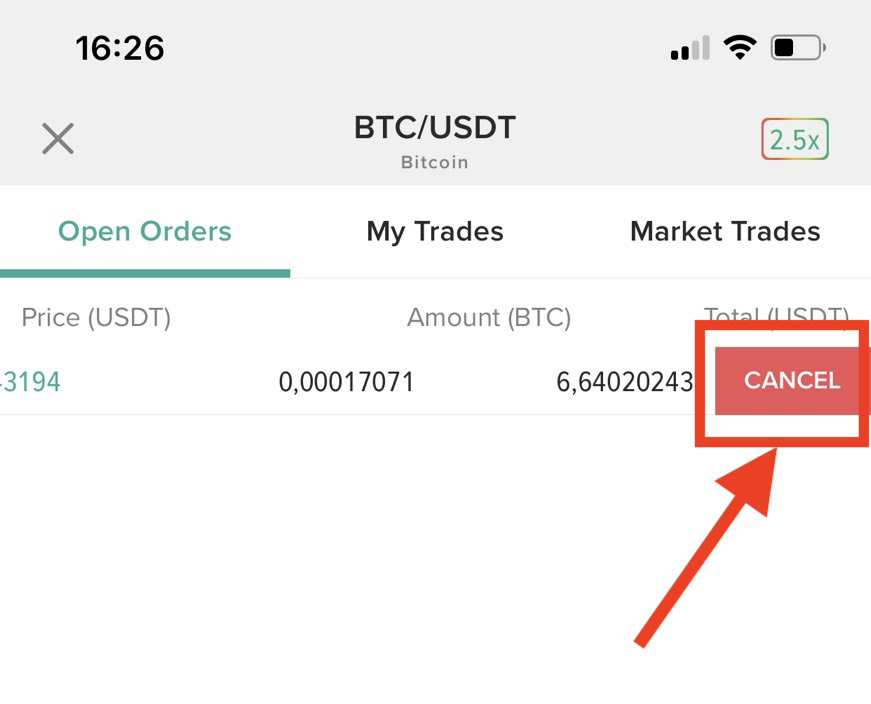

7. If you want to cancel your order:

-

Click [Cancel]

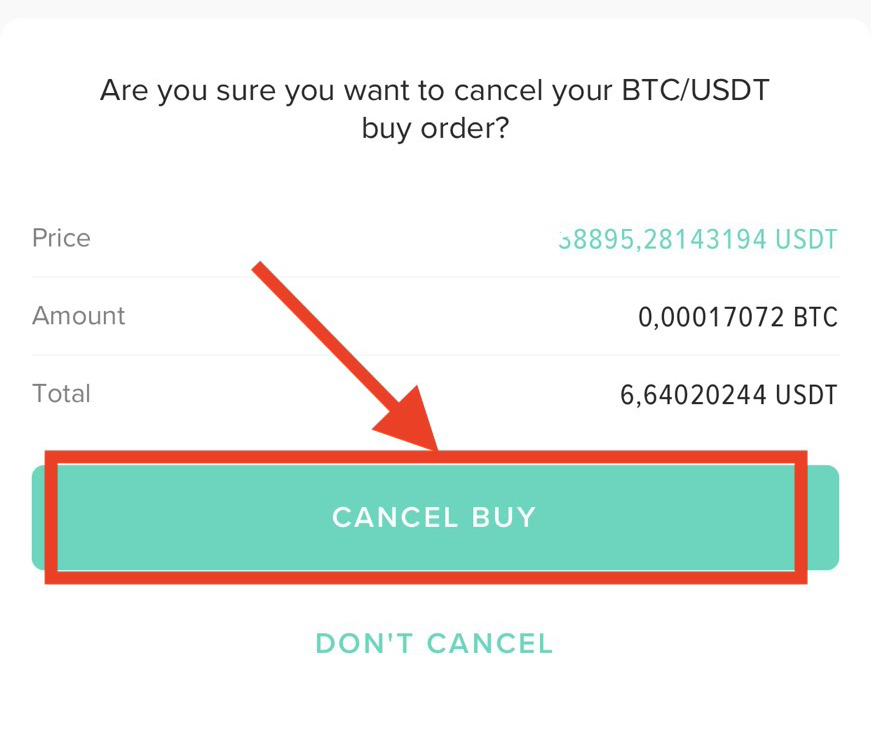

-

Then click [Cancel Buy]

Frequently Asked Questions (FAQ)

Stop-Limit Orders Explained

A stop-limit order is an order to place a regular buy or sell order (also known as a "limit order") when the highest bid or lowest ask reaches a specified price, known as the "stop." This can be helpful for protecting gains or minimizing losses.

Usually a stop-limit order will be executed at a specified price, or better (i.e. higher or lower than the specified price, depending on whether limit order relates to a bid or ask, respectively), after a given stop price has been reached. Once the stop price is reached, the stop-limit order becomes a limit order to buy or sell at the limit price or better.

Limit Orders Explained

You should use limit orders when you are not in a rush to buy or sell. Unlike market orders, the limit orders are not executed instantly, so you need to wait until your ask/bid price is reached. Limit orders allow you to get better selling and buying prices and they are usually placed on major support and resistance levels. You may also split your buy/sell order into many smaller limit orders, so you get a cost average effect.

When Should I Use a Market Order?

Market orders are handy in situations where getting your order filled is more important than getting a certain price. This means that you should only use market orders if you are willing to pay higher prices and fees caused by the slippage. In other words, market orders should only be used if you are in a rush.

Sometimes you need to buy/sell as soon as possible. So if you need to get into a trade right away or get yourself out of trouble, thats when market orders come in handy.

However, if youre just coming into crypto for the first time and you are using Bitcoin to buy some altcoins, avoid using market orders because you will be paying way more than you should. In this case, you should use limit orders.